Published online January 2023

Contents

1. Introduction

As part of the preparation of a new Local Development Plan (LDP) for Belfast, the Strategic Planning Policy Statement (SPPS) for NI (September 2015) states that “a system to monitor the take-up and loss of land allocated for economic development purposes should be implemented."

The primary purpose of the employment monitor is to inform the formulation of the council’s new LDP. However, it will also help the council identify where a shortfall in potential land supply might exist.

The information collated will allow a clear view of the overall progress in meeting the employment objectives of the emerging development plan and in identifying issues likely to require intervention.

The Planning Act (NI) 2011 requires the council to make an annual report to the Department for Infrastructure outlining the extent to which the objectives set out in the LDP are being achieved. Although the new plan is not yet adopted it is still important to report on the availability and take-up of employment land in advance of its adoption.

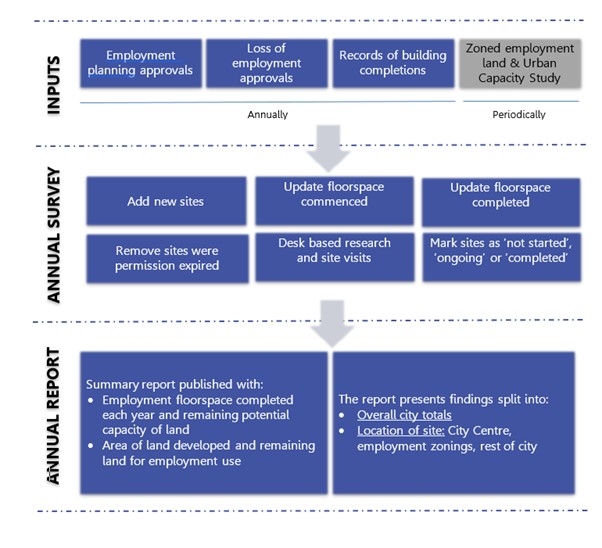

2. Methodology

This section will explain the data collection methods used to analyse employment land availability within the district. It provides information relating to employment land data between 1 April 2021 and 31 March 2022. An analysis has been undertaken of all new sites with planning approvals within the periods stated above. The survey identifies and records sites that have been completed, sites that are currently under construction and sites with outstanding planning permission, yet to be implemented. Any existing employment land which was lost to non-employment uses during the monitoring year has also been recorded. Sites identified for the purposes of this report are those that fall within Class B of the Use Classes Order. These are defined as:

| Classes | Uses |

|---|---|

| Class B1a | General offices |

| Class B1b | Call centres |

| Class B1c | Research and development |

| B2 | Light industry |

| B3 | General industry |

| B4 | Storage and distribution |

The methodology has been revised since the publication of the last report. Proposals that come forward with a mix of employment uses have been disaggregated into their respective use classes. The monitor also now captures instances where there is a loss and a gain of employment floorspace as part of the same proposal. These revisions ensure a greater degree of accuracy moving forward.

The process followed to produce the employment land monitor is summarised at Appendix A.

The Monitor presents a register of potential employment land, based on current planning policy designations and planning permissions [Footnote 1]. It is the role of an Urban Capacity Study (UCS) and the Employment Land Review which will be undertaken from time to time, to assess the suitability, availability and achievability of monitored sites to contribute to a viable supply of land.

[Footnote 1] For the purposes of the employment monitor, the draft Belfast Metropolitan Area Plan (BMAP) 2015 is utilised rather than the former Belfast Urban Area Plan (BUAP) 2001.The adopted BMAP was quashed as a result of a judgement in the Court of Appeal delivered on 18 May 2017 and, although this means the BUAP is now the statutory development plan for the area, the draft BMAP, in its most recent, pre-examination, form remains a significant material consideration in future planning decisions. Draft BMAP therefore refers to that which was purported to be adopted and not the pre-examination draft published in 2004.

3. Limitations

The figures included in this document do not include all development. It should therefore be assumed that some refurbishments and other permitted development have been developed and are not included in this document as there is no requirement for such works to be subject to the planning process. Where there has been an application permitted which includes intensification of an existing employment site, i.e. an extension or additional floor to existing employment building, only net additional floorspace is recorded as the site area already exists and would be misrepresentative.

It must also be recognised that the site area for planning applications expressed in hectares has been reduced in some instances to reflect only the site and not the access arrangements as this would have the potential to give misleading results. In a small number of schemes, the floorspace figures were not readily available and estimates of the floorspace gained or lost has been provided based on the existing building footprint and the number of storeys. Due to rounding, numbers presented throughout this report may not add up precisely to the totals provided.

4. Overview

The following summary tables detail the uptake and loss of employment space for the monitoring period (1 April 2021-31 March 2022). The position at the 31 March 2022 in terms of the remaining supply of vacant employment land and as well as committed floorspace gains through extant planning permission for B use classes balanced against committed losses (extant planning permission for alternative uses) for Belfast district is also included.

4.1 Belfast LGD overview 1 April 2021 - 31 March 2022

Table 1 provides a breakdown for the completed gains and losses in employment land over the monitoring year period of 1 April 2021 to 31 March 2022. The total amount of floorspace competed was 27,347 square metres (sqm). The majority of this was in use class B1(a) general offices. The total amount of completed employment floorspace lost to non-employment uses over the monitoring period was 4,898 sqm. The net change between completed losses and gains was 22,449 sqm.

4.2 Belfast LGD extant and under construction overview

Table 2 provides overall totals for schemes where development is ongoing and where planning permission remains extant on 31 March 2022. Under construction schemes at the 31 March have the potential to deliver approximately 70,501 sqm of new floorspace. The completion of all schemes yet to start has the potential to deliver approximately 432,952 sqm of new employment floorspace. Further analysis of the extant permissions demonstrates that approximately 82 per cent (354,712 sqm) consist of B1(a) general offices.

4.3 Belfast LGD completions (gains) and remaining capacity by location

Table 3 sets out the completions (gains) by location over the period 1 April 2021 to 31 March 2022. It also sets out the remaining capacity by way of extant planning permissions for employment use by location and areas of developable land within existing employment locations (that is, land where there is no development under construction or that does not have an extant planning consent). In line with best practice a 40 per cent building to plot ratio was applied to these areas to reflect the servicing, parking and landscaping requirements. As of the 31 March 2022 there is approximately 324,000 sqm of vacant land suitable for employment purposes.

4.4 Belfast LGD completions (losses) and remaining potential losses by location

Table 4 outlines the completed (losses) by location over the period 1 April 2021 to 31 March 2022. It also sets out the remaining potential losses of employment uses to non-employment uses if all extant planning permissions are realised. These extant planning permissions are located mostly within the city centre and the rest of the city.

4.5 Mixed use sites remaining capacity

There are four sites zoned for mixed use in draft BMAP. The yields for Titanic Quarter (BHA01) and Lands at Monagh By-Pass / Upper Springfield Road (BT 002) are captured in table 2 as they consist of extant planning permissions or development under construction. The yields on the remaining two mixed use zonings have been captured from their respective masterplans.

5. Summary tables

Table 1: Completions for Monitor period 1 April 2021 to 31 March 2022

| Office (B1A) | Call centres (B1B) | R & D (B1C) | Light industry (B2) | General Industry (B3) | Storage & Distribution (B4) | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | |

| Completed (gains) 1 April 2021 to 31 March 2022 | 7.4 | 27,055 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.4 | 292 | 7.8 | 27,347 |

| Completed (losses) 1 April 2021 to 31 March 2022 | 0.3 | 4,898 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 4,898 |

| Net Change | 7.1 | 22,157 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.4 | 292 | 8 | 22,449 |

Table 2: Development under construction, extant permission for gains and losses

| - | Office (B1A) | Call centres (B1B) | R & D (B1C) | Light industry (B2) | General Industry (B3) | Storage and Distribution (B4) | Vacant employment land | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| - | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 | Area (Ha) | m2 |

| Development ongoing at 31 March 2022 | 3.53 | 52463 | 0 | 0 | 1.58 | 11714 | 0.03 | 2886 | 0 | 0 | 0.94 | 3438 | * | * | 6 | 70501 |

| Not started gains - Full and Outline at 31 March 2022 |

63.71 | 354712 | 0 | 0 | 0.15 | 7798 | 10.86 | 21999 | 41.63 | 32028 | 12.19 | 16415 | * | * | 128.5 | 432952 |

| Sub-total | 67.24 | 407175 | 0 | 0 | 0.16 | 19512 | 10.89 | 24885 | 41.63 | 32028 | 13.12 | 19853 | * | * | 134.6 | 503453 |

| Losses not started at 31 March 2022 | 4.72 | 25155 | 0.13 | 2064 | 0.12 | 318 | 3.29 | 12200 | 2.4 | 6800 | 9.13 | 20309 | 0.41 | 2812 | 20.2 | 69658 |

| Net Total | 62.52 | 382,020 | -0.13 | -2064 | 1.62 | 19,194 | 7.6 | 12,685 | 39.23 | 25,228 | 3.99 | -456 | -0.41 | -2812 | 114.4 | 433,795 |

*For vacant employment land not covered by an existing planning consent refer to Table 3.

Table 3: Completions (gains) and remaining potential gains by location

| - | - | Completions (sqm) | Remaining Capacity (sqm) | |

|---|---|---|---|---|

| Ref No | Location | 01-04-2021 to 31-03-2022 | Remaining potential from extant permissions and under construction | Remaining potential from vacant developable land |

| CC | City Centre | 26,987 | 220,738 | 0 |

| ML 08 | Kilwee Industrial Estate, Dunmurry | 0 | 0 | 811 |

| BT 005/05 | Hillview Road | 0 | 3,543 | 1,416 |

| BT 005/19 | Ballygomartin Industrial Estate, Ballygomartin Road | 0 | 0 | 1,488 |

| BT 005/10 | Glenbank Business Park, Crumlin Road | 0 | 0 | 11,988 |

| BT 005/25 | North Howard Link | 0 | 0 | 0 |

| BT 005/15 | Kennedy Way | 68 | 3,698 | 0 |

| BT 005/04 | Castlereagh Road | 0 | 0 | 2,423 |

| MCH 09 | Prince Regent Road | 0 | 850 | 0 |

| ML 07 | Springbank Industrial Estate | 0 | 1,019 | 36,343 |

| BT 005/13 | Ravenhill Business Park | 0 | 0 | 0 |

| BT 005/09 | Shore Road/Skegioneill Street | 0 | 0 | 629 |

| BT 004 | Land At Springfield Road (Former Mackie's Site) | 0 | 0 | 65,122 |

| BT 005/11 | Donegall Road | 0 | 0 | 0 |

| BT 005/08 | Duncairn Gardens | 0 | 1,618 | 0 |

| BHA 06 | Belfast Harbour | 0 | 40,709 | 183,727 |

| BT 005/17 | Westlink Enterprise Centre, Distillery Street | 0 | 0 | 1,281 |

| MCH 10 | Montgomery Road | 0 | 9,132 | 0 |

| BT 005/20 | Lanark Way | 0 | 740 | 641 |

| BT 005/07 | York Road Including Jennymount Business Park | 0 | 563 | 0 |

| BT 005/12 | Stockmans Way | 292 | 0 | 0 |

| MCH 11 | Ballygowan Road | 0 | 0 | 0 |

| BT 005/02 | Island Street/Ballymacarrett Road | 0 | 0 | 331 |

| BT 005/21 | Argyle Business Park, Shankill Road | 0 | 749 | 0 |

| BT 005/01 | Newtownards Road/Tamar Street | 0 | 0 | 0 |

| BT 005/18 | Springfield Road | 0 | 0 | 7,675 |

| BT 005/22 | Agnes Street Industrial Estate | 0 | 0 | 0 |

| BT 005/03 | East Belfast Enterprise Park | 0 | 0 | 0 |

| BT 005/23 | Louden Street/Townsend Street | 0 | 0 | 0 |

| BT 005/16 | Whiterock Industrial Estate, Springfield Road | 0 | 12,635 | 6,652 |

| BT 005/26 | Conway Street | 0 | 0 | 0 |

| BT 005/06 | Cambrai Street | 0 | 310 | 0 |

| BT 005/24 | Andrews Mill, Divis Street | 0 | 0 | 0 |

| BT 005/14 | Glen Road | 0 | 20 | 0 |

| BHA 01 | Titanic Quarter | 0 | 83,259 | 0 |

| BT 002 | Lands At Monagh By-Pass | 0 | 0 | 0 |

| BT003 | Land At Crumlin Road Including Girdwood Barracks | 0 | 0 | 0 |

| BHA 05 | North Foreshore | 0 | 0 | 0 |

| ML 05 | Seymour Industrial Estate | 0 | 0 | 3,598 |

| ROC | Rest Of City | 0 | 123,570 | 0 |

| QOA | Queens Office Area | 0 | 300 | 0 |

| 27,347 | 503,453 | 324,125 | ||

| 827,578 | ||||

Table 4: Completions (losses) and remaining potential losses by location

| Completed losses (sqm) | Remaining potential losses (sqm) | ||

|---|---|---|---|

| Ref No | Location | 01-04-2021 to 31-03-2022 | Remaining commitments at 31-03-2022 |

| CC | City Centre | 4,898 | 25,032 |

| ML 08 | Kilwee Industrial Estate, Dunmurry | 0 | 0 |

| BT 005/05 | Hillview Road | 0 | 5,028 |

| BT 005/19 | Ballygomartin Industrial Estate, Ballygomartin Road | 0 | 0 |

| BT 005/10 | Glenbank Business Park, Crumlin Road | 0 | 0 |

| BT 005/25 | North Howard Link | 0 | 0 |

| BT 005/15 | Kennedy Way | 0 | 260 |

| BT 005/04 | Castlereagh Road | 0 | 0 |

| MCH 09 | Prince Regent Road | 0 | 0 |

| ML 07 | Springbank Industrial Estate | 0 | 0 |

| BT 005/13 | Ravenhill Business Park | 0 | 0 |

| BT 005/09 | Shore Road/Skegioneill Street | 0 | 0 |

| BT 004 | Land At Springfield Road (Former Mackie's Site) | 0 | 0 |

| BT 005/11 | Donegall Road | 0 | 0 |

| BT 005/08 | Duncairn Gardens | 0 | 381 |

| BHA 06 | Belfast Harbour | 0 | 7,300 |

| BT 005/17 | Westlink Enterprise Centre, Distillery Street | 0 | 0 |

| MCH 10 | Montgomery Road | 0 | 2,531 |

| BT 005/20 | Lanark Way | 0 | 2,683 |

| BT 005/07 | York Road Including Jennymount Business Park | 0 | 0 |

| BT 005/12 | Stockmans Way | 0 | 561 |

| MCH 11 | Ballygowan Road | 0 | 0 |

| BT 005/02 | Island Street/Ballymacarrett Road | 0 | 0 |

| BT 005/21 | Argyle Business Park, Shankill Road | 0 | 0 |

| BT 005/01 | Newtownards Road/Tamar Street | 0 | 0 |

| BT 005/18 | Springfield Road | 0 | 0 |

| BT 005/22 | Agnes Street Industrial Estate | 0 | 0 |

| BT 005/03 | East Belfast Enterprise Park | 0 | 0 |

| BT 005/23 | Louden Street/Townsend Street | 0 | 0 |

| BT 005/16 | Whiterock Industrial Estate, Springfield Road | 0 | 0 |

| BT 005/26 | Conway Street | 0 | 0 |

| BT 005/06 | Cambrai Street | 0 | 1,672 |

| BT 005/24 | Andrews Mill, Divis Street | 0 | 0 |

| BT 005/14 | Glen Road | 0 | 0 |

| BHA 01 | Titanic Quarter | 0 | 3,520 |

| BT 002 | Land At Monagh Bypass /. Upper Springfield Road | 0 | 0 |

| ML 05 | Seymour Industrial Estate | 0 | 0 |

| ROC | Rest Of City | 0 | 25,764 |

| Total | 4,898 | 74,732 |

Table 5: Mixed use sites remaining yield/capacity

| Zoning Reference | Location | Employment Yield |

|---|---|---|

| BHA 05 | North Foreshore | 38,140 |

| BT 003 | Land at Crumlin Road including Girdwood Barracks | 20,000 |

| BT 002 | Land at Monagh Bypass / Upper Springfield Road | 4,030 |

| BHA 01 | Titanic Quarter | 77,079 |

| Total | 139,249 |

Appendix A: Summary Methodology

The employment land monitor measures net gains and losses in employment floorspace within the Belfast City Council area. It provides a snapshot of the amount of land available for employment as of 1 April each year. The Monitor demonstrates the presence of an adequate and continuous supply of employment land in the city and provides evidence to inform the preparation of the Local Development Plan and to make planning decisions. The Monitor presents a register of potential employment land, based on current planning policy designations and planning permissions, rather than an accurate picture of viable employment land.

An Urban Capacity Study will be undertaken from time to time to assess the suitability, availability and achievability of monitored sites to ensure the land required to facilitate the required jobs growth over the plan period is met. An Urban Capacity Study for Belfast was published in March 2018.